The Ultimate Guide to Getting Pre-Approved for a Mortgage: Be a Competitive Homebuyer with Confidence

The Ultimate Guide to Getting Pre-Approved for a Mortgage: Be a Competitive Homebuyer with Confidence

Congratulations! You’ve decided to take the exciting step of buying a home. The journey from daydreams to housewarming party can feel overwhelming, but getting pre-approved for a mortgage is a crucial first step that will empower you throughout the process. This guide will equip you with everything you need to know about mortgage pre-approval, from understanding the process and its benefits to navigating the pre-approval steps with ease.

What is Mortgage Pre-Approval?

Think of pre-approval as a financial fitness report for your homebuying journey. It involves a lender evaluating your financial health to determine the maximum loan amount you’re eligible for. This assessment considers factors like your income, credit score, employment history, debt-to-income ratio (DTI), and assets. Upon successful pre-approval, you’ll receive a letter outlining the estimated loan amount you can qualify for, along with the interest rate and loan terms.

Why Get Pre-Approved? The Power of Preparation

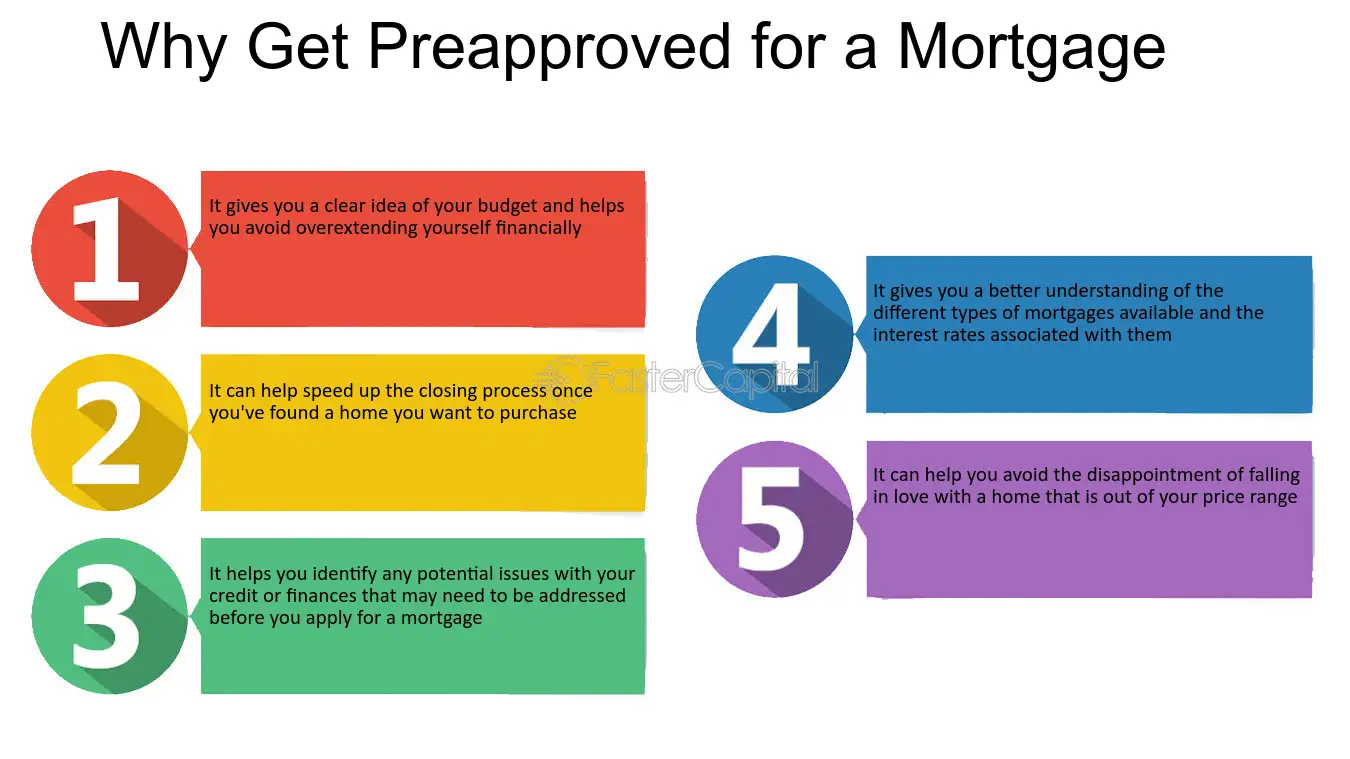

Pre-approval offers a multitude of advantages that make you a stronger and more informed homebuyer:

- Confidence and Clarity: Knowing your budget empowers you to focus on properties within your realistic price range. No more time wasted on dream homes beyond your reach.

- Stronger Negotiation Power: A pre-approval letter demonstrates to sellers that you’re a serious buyer with the financial backing to secure the deal. This can significantly strengthen your negotiation position when making offers.

- Streamlined Process: With your financial picture already assessed, the loan application process for a specific property becomes much faster. This can be crucial in competitive markets where quick decisions are essential.

- Peace of Mind: Pre-approval eliminates the anxiety of uncertainty. You’ll enter the house hunting phase with a clear understanding of your affordability and avoid last-minute surprises during the offer stage.

Getting Pre-Approved: A Step-by-Step Guide

Now that you understand the significance of pre-approval, let’s delve into the steps involved:

1. Choose Your Lender:

The first step is selecting a reputable mortgage lender. Consider factors like experience, loan product offerings, interest rates, and customer service reputation. Talk to friends, family, or real estate agents for recommendations.

2. Gather Your Documents:

The pre-approval process requires documentation to verify your financial standing. Here’s a general checklist, though specific requirements may vary by lender:

- Proof of Income: Paystubs for the past two to three months, W-2 forms for salaried individuals, and tax returns for self-employed individuals.

- Employment Verification: A letter from your employer confirming your position, salary, and length of employment.

- Asset Verification: Bank statements showing your savings, checking accounts, and investment holdings.

- Debt Documentation: Statements for any existing loans, including credit cards, auto loans, and student loans.

- Identification: Government-issued photo ID and Social Security number.

3. Submit Your Application:

Once you’ve gathered your documents, it’s time to formally apply for pre-approval. This can be done online, over the phone, or by meeting with a loan officer in person. Be prepared to answer questions about your financial situation and future homebuying plans.

4. Credit Check and Verification:

The lender will conduct a hard credit inquiry to assess your creditworthiness. This will impact your credit score slightly, but pre-approval inquiries are typically grouped together, minimizing the overall impact.

5. Underwriting and Pre-Approval Decision:

The lender will analyze your financial documents, credit report, and verification information. Based on this comprehensive assessment, they’ll issue a pre-approval letter outlining the loan amount, interest rate, and loan terms you qualify for.

Understanding the Pre-Approval Letter:

Your pre-approval letter is a valuable document, so take time to understand its key details:

- Loan Amount: This is the estimated maximum loan amount you’re eligible for.

- Interest Rate: This reflects the cost of borrowing the money and is influenced by your credit score and loan terms.

- Loan Terms: This section outlines the type of loan (fixed-rate, adjustable-rate), loan term (length of the loan repayment period), and any down payment requirements.

- Contingencies: The letter may mention conditions that need to be met before final loan approval, such as property appraisal or verification of employment.

Pre-Approval Timeline and Considerations

Pre-approval letters are typically valid for 60 to 90 days. This timeframe allows you to actively search for homes within your budget and make competitive offers. However, certain factors can impact your pre-approval status during this period:

- Job Changes: Significant changes in employment, like a job loss or change in income, can affect your pre-approval. Communicate any changes to your lender promptly.

- Credit Report Fluctuations: Avoid taking on new debt or opening new credit lines during the pre-approval window. These changes can negatively impact your credit score and potentially jeopardize your pre-approval.

- Large Purchases: Avoid making large purchases that could significantly deplete your savings or reserves. Maintaining your financial stability is crucial for securing the final loan.

Beyond the Basics: Tips for a Smooth Pre-Approval Process

- Shop Around for Rates: Don’t settle for the first lender you come across. Compare rates and terms from multiple lenders to ensure you’re getting the best possible deal.

- Ask Questions: Don’t hesitate to ask your lender questions about the pre-approval process, loan options, and any concerns you may have.

- Be Transparent: Provide your lender with complete and accurate financial information. Transparency fosters trust and streamlines the process.

- Consider Down Payment Options: A larger down payment can translate to a lower loan amount, potentially qualifying you for a better interest rate. Explore different down payment options to find the sweet spot between affordability and long-term financial comfort.

- Prepare for Closing Costs: Factor in closing costs, which are additional fees associated with securing a mortgage. These can include origination fees, appraisal fees, title insurance, and recording fees. Understanding these costs will help you budget effectively.

Conclusion: Pre-Approval: Your Key to Homebuying Success

By getting pre-approved for a mortgage, you’re taking control of your homebuying journey. It empowers you with a clear financial picture, strengthens your negotiating position, and streamlines the process. Remember, pre-approval is an investment in your success. With the right preparation and knowledge, you can navigate this crucial step confidently and move closer to your dream home.

Bonus Tip: Consider getting pre-approved with multiple lenders to compare rates and terms. However, keep in mind that multiple hard credit inquiries within a short period can have a slightly more significant impact on your credit score.

Additional Resources:

While this guide equips you with the core knowledge of mortgage pre-approval, there’s a wealth of additional resources available to hone your homebuying expertise. Consider exploring these resources:

- U.S. Department of Housing and Urban Development (HUD): https://www.hud.gov/ offers a variety of resources for first-time homebuyers, including information on mortgage loans and down payment assistance programs.

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/ provides educational materials and tools to help you understand mortgages and make informed financial decisions.

- National Association of Realtors (NAR): https://www.nar.realtor/ offers a wealth of resources for homebuyers, including tips on finding a real estate agent and negotiating offers.

Congratulations on taking the first step towards homeownership! By following these steps and conducting further research, you’ll be well on your way to securing your dream home.