Conquering Your Credit Score for Better Loan Rates

Conquering Your Credit Score for Better Loan Rates

Have you ever dreamt of owning a home, starting a business, or simply driving a new car? These goals often require financing, and lenders heavily rely on a crucial three-digit number to decide your eligibility and interest rates: your credit score.

This blog post is your one-stop guide to understanding credit scores, the factors that influence them, and powerful strategies to build a score that unlocks the doors to better loan rates and a brighter financial future.

Demystifying the Credit Score

A credit score is a numerical representation (usually ranging from 300 to 900) of your creditworthiness. It’s a snapshot of your past borrowing behavior and how responsibly you’ve managed credit products like loans and credit cards. Lenders use this score to assess the risk of lending you money. A higher score indicates a lower risk of defaulting on payments, making you more attractive to lenders and potentially qualifying you for better interest rates.

The Credit Score Orchestra: Factors That Play a Role

Several factors work together to create your unique credit score symphony. Here are the key instruments in this orchestra:

- Payment History (35%) This is the most significant factor. Timely payments on loans and credit cards show responsible credit management and positively impact your score. Conversely, missed or late payments can significantly bring it down.

- Credit Utilization Ratio (30%) This refers to the amount of credit you’re using compared to your total credit limit. Ideally, you should keep your credit utilization ratio below 30%. Maxing out your credit cards can negatively affect your score.

- Length of Credit History (15%) A longer credit history generally translates to a higher score. This demonstrates your experience in managing credit over time. Having a mix of credit products, like credit cards and loans, can also be beneficial.

- New Credit Inquiries (10%) Frequent applications for new credit cards or loans can lead to a slight dip in your score. This is because lenders see it as a potential sign of financial overextension. However, inquiries for mortgages or auto loans typically have a less severe impact.

- Credit Mix (10%) Having a healthy mix of credit products, such as credit cards, installment loans (mortgages, car loans), and revolving credit (credit cards), can positively influence your score. It showcases your ability to manage different types of credit.

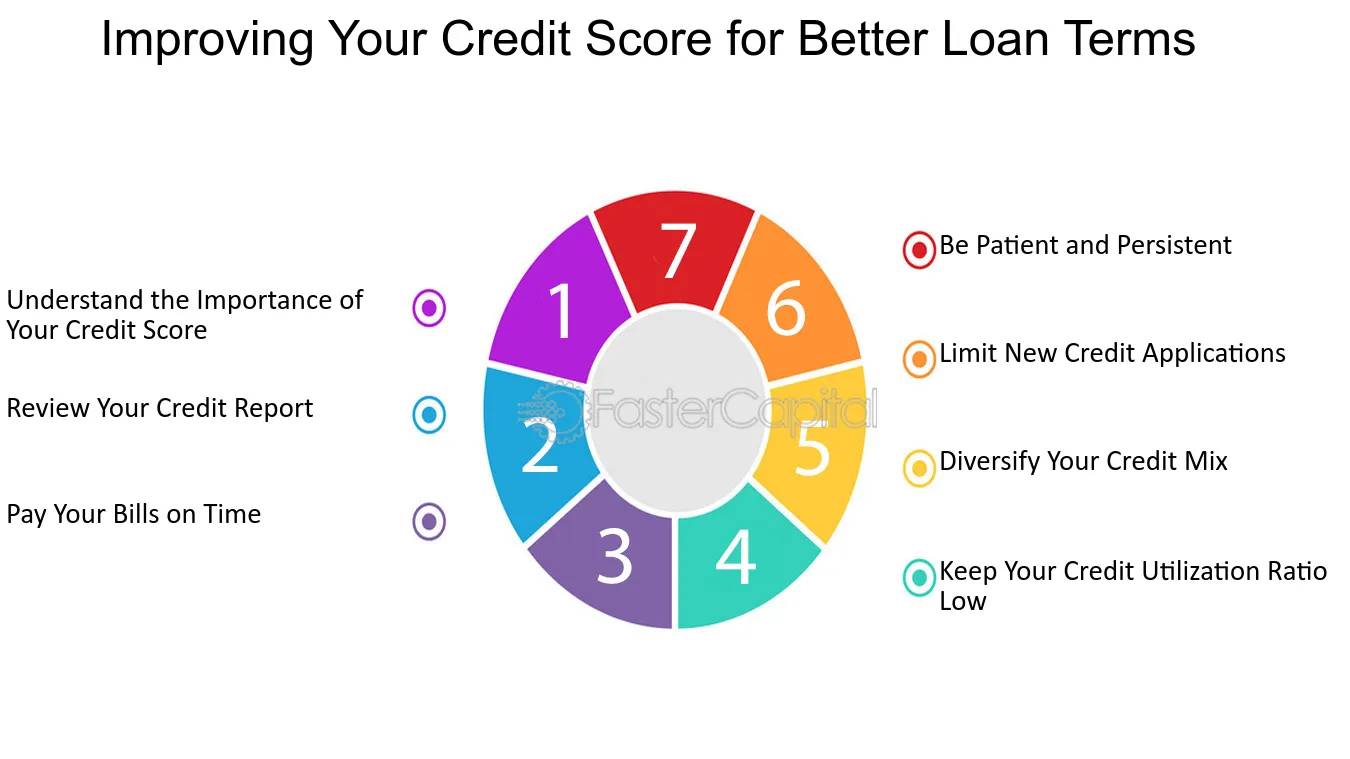

Building a Credit Score Symphony: Strategies for Improvement

Now that you understand the instruments that make up your credit score, let’s delve into strategies to create a harmonious and high-scoring composition:

- Become a Payment Maestro: Make timely payments on all your credit card bills and loans. Even a single missed payment can significantly impact your score. Set up automatic payments to avoid unintentional delinquencies.

- Utilize Credit Wisely: Don’t max out your credit cards. Aim to keep your credit utilization ratio below 30%. Pay down existing credit card balances to improve your score.

- Time is Money (and Credit Score): Building a long credit history is crucial. Don’t close old accounts in good standing, even if you don’t use them frequently. The longer your credit history, the better.

- Apply Strategically: Avoid applying for multiple credit cards or loans simultaneously. Each application can result in a hard inquiry, which can slightly lower your score. Plan your credit applications and space them out.

- Maintain a Credit Mix: Having a healthy mix of credit products, like credit cards used responsibly and installment loans managed well, can positively impact your score.

Beyond the Basics: Advanced Credit Score Tactics

Here are some additional tips for credit score enthusiasts:

- Become an Error Detective: Regularly review your credit reports for errors. Inaccuracies can bring down your score. Dispute any errors you find with the credit bureau that issued the report. You can get a free credit report from each of the three major credit bureaus (Experian, Equifax, TransUnion) annually.

- Become a Good Neighbor: If you have limited credit history, consider becoming an authorized user on a family member’s credit card with a good payment history. This can help piggyback on their positive credit history and improve your own score.

- Seek Professional Help: If you’re struggling to improve your credit score on your own, consider consulting a credit counselor. They can provide personalized guidance and develop a credit repair plan.

The Credit Score Journey: A Marathon, Not a Sprint

Building a good credit score takes time and consistent effort. Don’t get discouraged if you don’t see immediate results. By following the strategies outlined above and practicing responsible credit management, you can gradually improve your score and unlock a world of financial opportunities. Remember, a high credit score translates to better loan rates, potentially saving you thousands of dollars in interest payments over the long time

The Credit Score and Your Financial Future

Your credit score goes beyond just loan applications. It can also impact your insurance rates, apartment rentals, and even your job prospects. Landlords often check credit scores to assess a tenant’s financial responsibility, and some employers may do the same to gauge your overall financial stability. A strong credit score can open doors to better opportunities across various aspects of your life.

Beyond the Score: Building Healthy Financial Habits

While a high credit score is desirable, it’s crucial to remember that it’s a reflection of your overall financial health. Here are some additional tips to cultivate healthy financial habits that go beyond just improving your score:

- Budgeting is Key: Create a realistic budget that tracks your income and expenses. Allocate funds for savings and debt repayment. Sticking to a budget will help you manage your finances effectively.

- Embrace Saving: Make saving a priority. Set financial goals and build an emergency fund that can cover unexpected expenses. Aim to save at least 3-6 months of living expenses.

- Debt Management: If you have debt, develop a plan to pay it down strategically. Prioritize high-interest debt first and consider debt consolidation strategies to simplify your repayment process.

- Live Within Your Means: Avoid impulse purchases and unnecessary spending. Focus on living within your means and prioritize your financial needs over wants.

Maintaining Your Credit Score Symphony

Once you’ve achieved a good credit score, don’t become complacent. Here are some tips to maintain a high score over time:

- Continue Timely Payments: Maintaining a consistent record of on-time payments remains crucial.

- Monitor Your Credit Reports: Regularly check your credit reports for errors and dispute any inaccuracies promptly.

- Be Mindful of Credit Utilization: Avoid exceeding your credit limits and maintain a healthy credit utilization ratio.

- Limit New Credit Inquiries: Only apply for new credit when absolutely necessary.

Conclusion: You Are the Conductor of Your Credit Score

Your credit score is a powerful tool that can significantly impact your financial well-being. By understanding the factors that influence it and implementing the strategies outlined in this guide, you can take control of your credit score and unlock a brighter financial future. Remember, you are the conductor of your credit score symphony. With dedication and responsible financial management, you can create a harmonious composition that opens doors to better loan rates, improved financial opportunities, and overall financial security.

Additional Resources:

- Annual Credit Report: https://www.annualcreditreport.com/index.action

- Consumer Financial Protection Bureau: https://www.consumerfinance.gov/

This comprehensive guide empowers you to embark on your credit score journey. Remember, with knowledge, discipline, and a commitment to healthy financial habits, you can conquer your credit score and achieve your financial goals.