The FAFSA Application: A Step-by-Step Guide

Decoding Financial Aid: A Guide to the FAFSA and Maximizing Your College Funding

College – a dream destination for many, but the cost can feel like a roadblock. Fear not, future scholar! The Free Application for Federal Student Aid (FAFSA) is your key to unlocking a treasure trove of financial aid opportunities. This blog equips you with everything you need to navigate the FAFSA application process and unlock the doors to grants, scholarships, and work-study programs.

Understanding the FAFSA Landscape

The FAFSA is the gateway to federal student financial aid in the US. It assesses your financial need and determines your eligibility for various programs. Here’s a breakdown of the key players:

- Federal Student Aid (FSA): Oversees the distribution of federal financial aid.

- Department of Education (DoEd): Manages the FAFSA application process.

- Financial Aid Office: Every college has one; they determine your financial aid package based on FAFSA data and institutional aid.

The FAFSA Application: A Step-by-Step Guide

Ready to dive in? Here’s a roadmap to navigate your FAFSA application:

-

Gather Your Documents:

- Social Security numbers for you and your parents/guardians (if dependent).

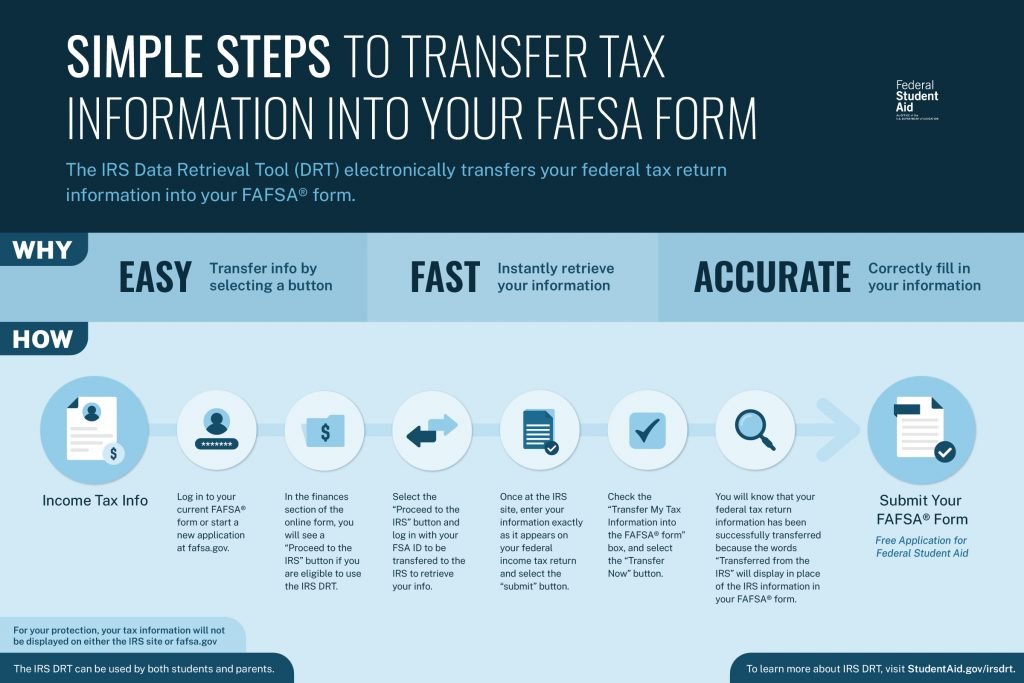

- Federal tax return documents (IRS W-2s, 1040s) for you and your parents/guardians (if dependent).

- Records of untaxed income (e. g., interest income).

- Records of assets (savings accounts, investments).

- Alien Registration Card (if you’re not a U.S. citizen).

-

Create an FSA ID: This acts as your digital signature for accessing federal student aid resources. You and your parents/guardians (if dependent) will each need an FSA ID. Apply online at [studentaid.gov].

-

Complete the FAFSA Application: The FAFSA is available online at [studentaid.gov] starting on October 1st for the following academic year. The application process involves: * Identifying yourself: Enter your personal information, educational background, and contact details. * School Selection: List up to ten colleges you’re considering. * Financial Information: Enter your income, assets, and living situation details. If you’re dependent, your parents’/guardians’ information will also be required. * Review and Submit: Carefully review your application for accuracy before submitting it electronically.

-

Monitor Your Status: The DoEd will process your FAFSA and send a Student Aid Report (SAR) summarizing the information you provided and your estimated Expected Family Contribution (EFC).

-

College Financial Aid Office: Each college you listed will receive your FAFSA data. They will use it, along with their own institutional aid policies, to create your financial aid package. This package typically includes a combination of grants, scholarships, work-study programs, and loans.

Maximizing Your Financial Aid: Strategies and Tips

The FAFSA application is just the beginning. Here are some strategies to maximize your financial aid opportunities:

Apply Early: The FAFSA operates on a first-come, first-served basis. Apply as soon as possible on October 1st (or shortly thereafter) to increase your chances of receiving federal and state aid.

Federal Grants: Grants are free money that doesn’t need to be repaid. Here are some key federal grants: * Pell Grant: Awarded to undergraduate students with exceptional financial need. * Federal Supplemental Educational Opportunity Grant (FSEOG): Priority is given to Pell Grant recipients with exceptional financial need. * TEACH Grant: Awarded to students who agree to teach in high-need fields after graduation.

Scholarships: Scholarships are free money awarded based on merit (academic achievement, extracurricular activities), talent, or specific criteria set by the scholarship provider. Research scholarships offered by: * Colleges and universities you’re applying to. * Your state government or local organizations. * National scholarship organizations based on your field of study or demographics. * Private companies and foundations.

Work-Study Programs: Federal Work-Study (FWS) allows you to earn money on campus or for approved off-campus employers. The program prioritizes students with financial need.

Appealing Your Financial Aid Award

Sometimes, your initial FAFSA-based financial aid package might not fully meet your needs. Don’t despair! You can appeal the decision if there have been significant changes in your financial circumstances since you submitted the FAFSA. Here’s what you need to do:

- Gather Documentation: Collect documents that prove your financial hardship, such as unexpected medical bills, job loss, or a change in dependency status.

- Contact the Financial Aid Office: Explain your situation and request a review of your financial aid award. Be professional, courteous, and provide clear documentation.

- Be Prepared: The financial aid office might have limited resources for adjustments. Be prepared to negotiate and explore alternative options within your package.

Making the Most of Your Financial Aid Package

Understanding your financial aid package is crucial. Here’s how to maximize its benefits:

- Review Your Package Carefully: Identify the types and amounts of grants, scholarships, work-study, and loans offered.

- Prioritize Free Money: Grants and scholarships are free money you don’t have to repay. Utilize them first to minimize your reliance on loans.

- Work-Study: Consider the work-study program as a way to earn money while gaining valuable work experience.

- Negotiate (if possible): Some colleges might have some flexibility with institutional aid awards. Explore the possibility of negotiating a slightly higher scholarship or grant amount, especially if you have received a better offer from another college.

Smart Borrowing Strategies

While grants, scholarships, and work-study are ideal, you might need loans to bridge the gap. Here are some smart borrowing strategies:

- Federal Loans vs. Private Loans: Prioritize federal student loans. They generally offer lower interest rates, income-based repayment options, and loan forgiveness programs. Explore private loans only if federal loans aren’t sufficient.

- Borrow Only What You Need: Don’t be tempted to borrow more than you absolutely need. Remember, you’ll be responsible for repaying the loan with interest after graduation. Create a budget and estimate your living expenses to determine the minimum loan amount required.

- Subsidized vs. Unsubsidized Loans: Subsidized loans accrue no interest while you’re enrolled at least half-time and during eligible grace periods after graduation. Opt for subsidized loans whenever possible. Unsubsidized loans accrue interest from the time they’re disbursed.

- Exit Strategies: Before borrowing, explore loan repayment options and forgiveness programs. Understand the implications of different repayment plans and choose one that aligns with your future career goals and financial situation.

Conclusion

College can be expensive, but with the FAFSA as your key, you can unlock a treasure trove of financial aid opportunities. By applying early, strategically utilizing grants, scholarships, and work-study programs, and practicing smart borrowing techniques, you can minimize your financial burden and focus on achieving your academic goals. Remember, the road to college funding starts with completing the FAFSA. So, take a deep breath, gather your documents, and get ready to unlock your financial aid potential!

Additional Resources:

- Federal Student Aid website: [studentaid.gov]

- Your college’s financial aid office website

- Scholarship search engines: Fastweb, Scholarships.com

Remember, knowledge is power. By understanding the FAFSA process and available financial aid options, you can navigate the college financing journey with confidence. Now go forth and conquer your academic dreams!