Student Loan Repayment Strategies and Forgiveness Options

Conquering the Climb: Student Loan Repayment Strategies and Forgiveness Options

Student loans can feel like a mountain you’ll never summit. The weight of debt can be overwhelming, but there are strategies and resources available to help you navigate the climb and reach the peak of financial freedom. This blog delves into the world of student loan repayment, exploring different plans, forgiveness programs, and cost-saving tactics.

Demystifying Repayment Plans:

Federal student loans offer a variety of repayment plans to cater to your income and financial situation. Here’s a breakdown of the most common ones:

- Standard Repayment Plan: This is the default plan with fixed monthly payments spread over 10 years. It’s a good choice if you have a steady, high income and want to pay off your loans quickly.

- Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payments based on your income and family size. Options include IBR (Income-Based Repayment), PAYE (Pay As You Earn), and REPAYE (Revised Pay As You Earn). IDR plans can significantly lower your monthly payments, but the repayment period extends to 20 or 25 years, potentially leading to more interest paid overall.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. It can be helpful if you expect your income to rise in the future.

- Income-Contingent Repayment (ICR) Plan: Similar to IDR plans, ICR bases payments on your income but offers the longest repayment term (up to 25 years) and may be suitable for those with very high debt or low income.

Choosing the Right Repayment Plan:

The optimal plan depends on your financial picture. Consider these factors:

- Income: If your income is low or unpredictable, an IDR plan may be the best fit.

- Debt amount: Higher debt burdens may benefit from extended repayment periods offered by IDR plans.

- Financial goals: Do you prioritize paying off loans quickly or having lower monthly payments to free up cash for other goals?

- Loan type: These plans are generally only available for federal student loans.

Exploring the Forgiveness Frontier:

Several programs offer student loan forgiveness, essentially erasing your remaining debt after meeting specific criteria. Here are some key programs to be aware of:

- Public Service Loan Forgiveness (PSLF): If you work full-time for a qualifying public service employer (government or non-profit) and make 120 on-time monthly payments under an IDR plan, your remaining federal student loan debt may be forgiven. Explore the program’s requirements carefully to ensure eligibility.

- Teacher Loan Forgiveness: Qualified teachers who work in low-income schools for five consecutive years can have up to $17,500 of their federal student loans forgiven.

- Income-Based Repayment (IBR) Forgiveness: After 20 or 25 years of on-time payments under an IDR plan, any remaining federal student loan debt may be forgiven. However, the forgiven amount is considered taxable income.

Exploring Forgiveness Requirements:

It’s crucial to understand the requirements for each program before getting your hopes set. Here are some general points to consider:

- Employer qualification: PSLF has specific eligibility criteria for employers. Double-check with your employer to ensure they qualify.

- Subject area: Teacher Loan Forgiveness may have limitations on qualifying subjects or grade levels.

- Payment plan: Loan forgiveness programs often require enrollment in specific repayment plans, like IDR plans.

- Tax implications: Discharged loan debt under certain programs may be considered taxable income. Consult a tax professional for guidance.

Cost-Cutting Strategies for Climbing Lower:

Beyond repayment plans and forgiveness, there are strategies you can employ to minimize student loan costs:

- Minimize borrowing: Only borrow what you absolutely need for your education. Explore scholarships, grants, and work-study programs to reduce your reliance on loans.

- Shop around for loans: Compare interest rates on federal and private loans before taking one out.

- Consider refinancing: If you have good credit and private loans with high-interest rates, refinancing to a lower rate can save you money over time.

- Make extra payments whenever possible: Even small additional payments can significantly reduce your total interest paid and shorten the repayment timeframe.

- Take advantage of interest accrual breaks: During periods of deferment or forbearance, interest may accrue on unsubsidized loans. Consider making payments during these times to avoid snowballing interest.

Beyond Federal Loans: Private Loan Options and Considerations

While this blog has focused on federal student loans, private loans are another reality for many borrowers. Here’s a quick overview:

- Private loans: Issued by banks and credit unions, these loans typically have higher interest rates than federal loans and may have less flexible repayment options.

- Considerations: Exhaust federal loan options first due to their generally more favorable terms. Only consider private loans if absolutely necessary, and compare interest rates and repayment terms carefully.

Taking Advantage of Tax Benefits:

The good news is that the government offers some tax breaks to help ease the burden of student loan payments:

- Student Loan Interest Deduction: You may be able to deduct up to $2,500 of the interest you paid on your qualified student loans on your federal taxes.

- Employer Loan Repayment Assistance: Some employers offer programs to help employees repay student loans. Check with your HR department to see if this benefit is available.

The Importance of Staying Organized:

Managing multiple loans and repayment plans can feel overwhelming. Here are some tips to stay organized:

- Consolidate loans: Consider consolidating multiple federal loans into one loan to simplify tracking and payments.

- Track your progress: Utilize online tools or create a spreadsheet to track your loan balances, interest rates, and repayment progress.

- Stay informed: Sign up for automatic updates from your loan servicers to stay on top of important deadlines and changes.

Building a Support System:

Don’t feel like you have to navigate student loan repayment alone. Here are some resources for support:

- Student loan counseling: Non-profit organizations offer free or low-cost student loan counseling to help you understand your options and develop a repayment strategy.

- Financial advisors: Consider seeking professional financial advice, especially if your loan situation is complex.

Remember, You Are Not Alone:

Student loan debt is a common challenge. Don’t be discouraged. By understanding your repayment options, exploring forgiveness programs, and implementing cost-saving strategies, you can tackle your student loans head-on and reach a place of financial freedom.

Taking Action:

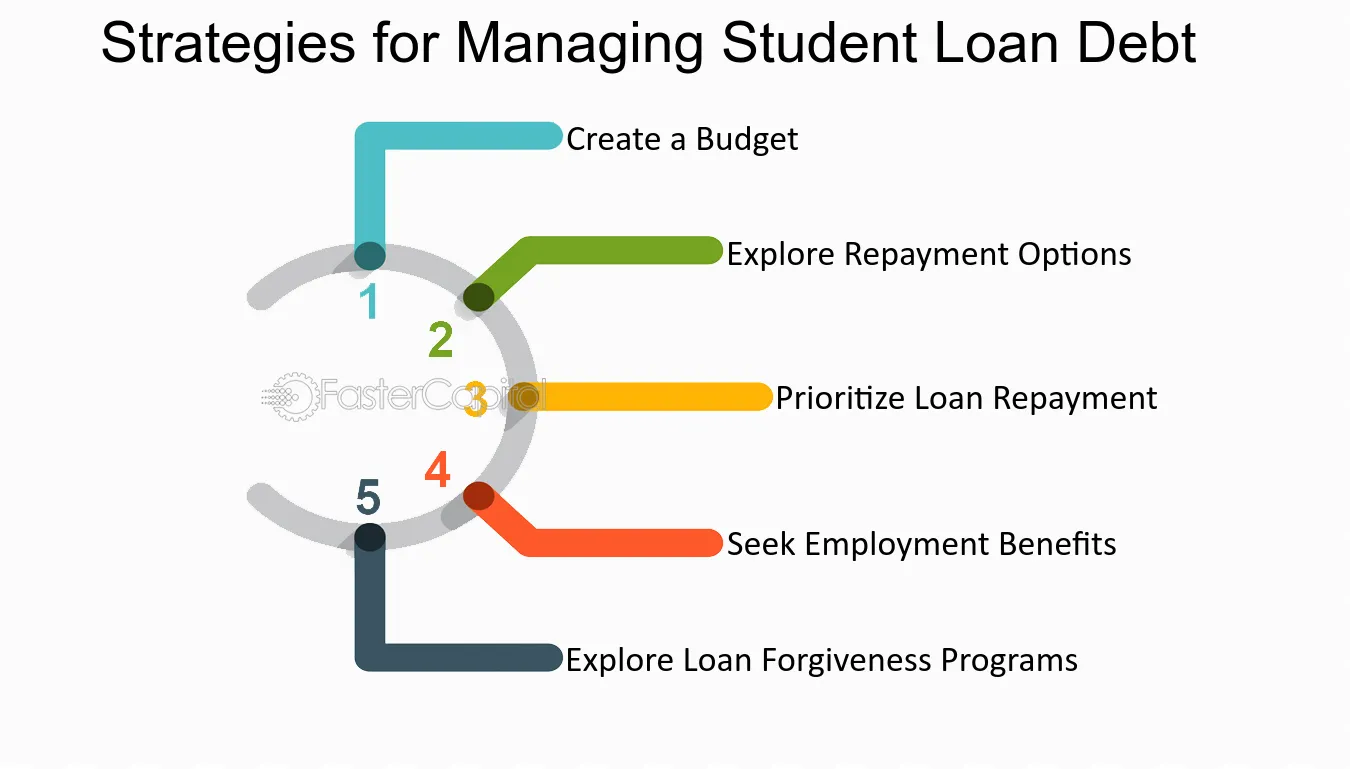

Here are some actionable steps you can take right now:

- Gather your loan information: Collect details on your loan balances, interest rates, and servicers.

- Explore repayment options: Research the various federal repayment plans and see which best suits your financial situation.

- Investigate forgiveness programs: See if you qualify for any loan forgiveness programs based on your career path or loan type.

- Consider refinancing: If you have private loans with high-interest rates, explore refinancing options to potentially lower your payments.

- Create a budget: Develop a plan to manage your income and expenses, prioritizing student loan payments.

By taking these steps, you can gain control of your student loan debt and chart a course towards financial well-being. Remember, knowledge is power. Equip yourself with the information and strategies outlined in this blog, and you’ll be well on your way to conquering the mountain of student loan debt.